APRIL 24, 2025

Upcoming US Import Changes

Effective May 2, 2025, de minimis (duty- and tax-free) treatment will be eliminated for low value-shipments of goods manufactured in China, Hong Kong SAR China. Previously, shipments going to a single importer valued at less than 800 USD were exempt from duties and taxes and underwent a simplified clearance process.

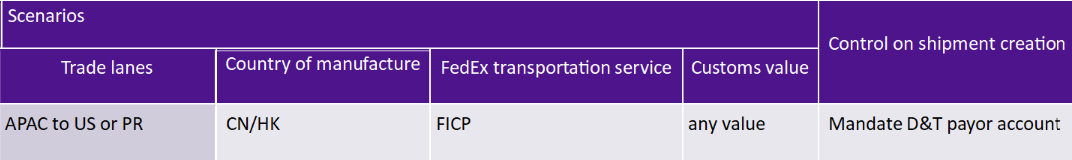

Beginning April 25, we are making changes to our online shipping platforms (FedEx Ship Manager®at fedex.com, FedEx Web Services, FedEx APIs) for all shipments to the U.S. or Puerto Rico that originate in APAC. These edits will not be available in our offline solutions (FedEx Ship Manager®Server, Global Ship Manager and FedEx Ship Manager®Software) at this time, but the applicable requirements for account number and HS code still exist.

Affected Trade Lanes:

Destination: United States & Puerto Rico

Origin: Australia, China, Hong Kong SAR China, Indonesia, Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, Taiwan, Vietnam

Commodity Country of Manufacture: China, Hong Kong SAR China

.

Note: Due to the B2C focus of FedEx®International Connect Plus (FICP), please note the additional requirement of payor account number when the recipient is billed for duties and taxes.

Customers will receive an error message and not be able to complete the shipment if the information is missing. Error messages for both Web Services and API:

"code": "ACCOUNTNUMBER.MINIMUMLENGTH.REQUIRED",

"message": "Enter a valid 9-digit FedEx account number."

Please be sure to check back for future updates and news.